Further to our recent communication regarding the UK’s EU Referendum, we are pleased to offer our more considered thoughts on what lies ahead.

The decision by the UK to leave the EU comes as a major shock for investors, with heightened uncertainty and volatility looking to remain for some time. In the near-term, the UK is likely to experience a period of lower growth with a possibility of higher inflation due to the weakness of Sterling.

The referendum outcome has resulted in political upheaval with David Cameron resigning and Theresa May securing the position of Prime Minister. The new PM’s initial stance has reinforced that Brexit is Brexit, although she has suggested that there be no rush to trigger Article 50 of the Lisbon Treaty. We believe it is unlikely that a snap General Election will be held due to the fixed term parliament of 5 years, as implemented in 2011.

The opposition Labour Party remains divided with a leadership contest commencing from Jeremy Corbyn, Owen Smith, and Angela Eagle, and there is little prospect that they can hold the current government to account in the medium term. We also have the prospect that the SNP will demand a second referendum on their independence and possible contagion within the European Union.

Policy makers and Central Banks will attempt to calm fears over the economy, with the possibility of the Bank of England cutting interest rates and pursuing a looser monetary policy i.e. more quantitative easing. As a result, Sterling will be under pressure for the foreseeable future.

Looking further afield, the shock to financial markets is likely to keep interest rates lower for longer across the world, and may prompt further stimulus. The US Federal Reserve, which has already postponed a hike from June partly due to Brexit fears, could now keep interest rates on hold for the rest of this year.

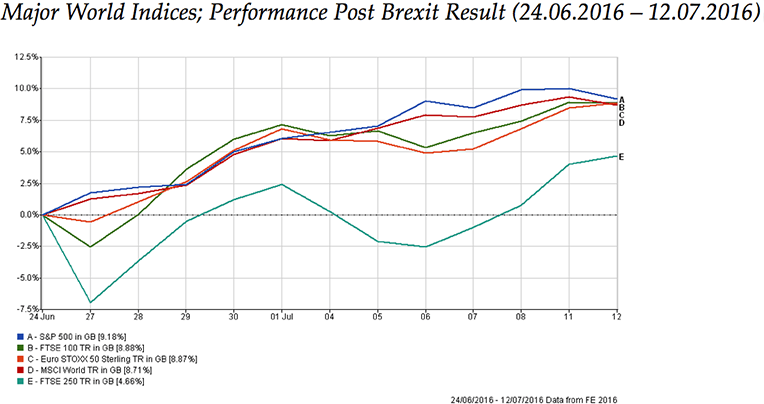

Despite the backdrop of uncertainty, both politically and economically, since the Brexit result on 24th June, risk-on asset classes have since rallied strongly with the S&P 500 reaching record highs, and strong recovery shown in both the FTSE 100 and the MSCI World Index.

With regards to the Baggette Wealth Management portfolios, we believe that our holistic approach to investing will continue to add value over the long term and we remain committed to diversifying the portfolios across global markets and asset classes. There has recently been a lot of press commentary with regards to commercial property funds, and although we believe that commercial property remains a valuable asset class over the long term, we are aware of the current stress within this sector and the fact that some funds are temporarily closed to redemptions. We are following closely the developments within the funds held.

The future remains uncertain, with many outcomes possible. We continue to monitor the performance of asset classes within the portfolios, and will communicate with you if we feel the need to make tactical asset allocation decisions.

In the meantime, please find below a snapshot of the world markets and BWM portfolios over the period since Brexit:

Yours sincerely

Nick Kesley

Chairman of BWM Investment Committee