The first quarter has surprised many pundits with the sharp rebound in both equity and commodity markets. This is following continued central bank support, the gradual stabilisation of the Chinese economy along with geopolitical risks receding. Both the US and UK economies continue to grow albeit at a slow rate, and there have been some en- couraging signs from some of the European economies, although BREXIT remains a cloud on the horizon.

REFERENDUM– A TWO HORSE RACE

There is no doubt that the upcoming referendum is the major topic of discussion for the markets this quarter, with the outcome being uncertain (odds as of 24/4/16 shown on the right). The campaigns have become more acrimonious. with both sides issuing claims and counter claims on a daily basis. Negativity seems to be the central.

point of each sides campaign with neither side concentrating on the positives of their position.

Uncertainty surrounding the BREXIT referendum has consequences for the financial market. Leading up to the vote sterling is likely to be vulnerable on concerns of capital flight risk, UK property market activity will remain subdued until the result is known; European and UK equity markets will remain volatile and fixed income gilt yields will remain at historically low levels, although there is a risk that yields may rise leading up to and in the event of a BREXIT.

In the event of either outcome, one could expect the following impacts on the core asset classes:

| Scenario 1: BREMAIN | Scenario 2: BREXIT | |

| Sterling | Sterling to recover from its recent weakness and will become dependent on economic fundamentals | Negative sentiment to remain on capital flows which are need- ed to fund a current account deficit |

| UK fixed income | Gilt yields to remain low in the short term however, higher yields may occur in the longer term due to improving economy | Higher yields in the short-term, but as investors adapt to the new BREXIT environment, UK gilts could benefit from safe- haven status and a possibility of further loosening of monetary policy by the Bank of England |

| UK equities | Markets to rally in the short-term. Greater economic certainty will encourage overseas investors to the UK | Short-term negative sentiment, particularly for financials and exporters to Europe however, large-caps due to their global focus are less vulnerable to the domestic market compared to the domestically exposed small/mid cap companies |

| UK property | Inflows from overseas investors taking advantage of the at- tractive exchange rate to underpin the market | Subdued actively until a clearer picture emerges |

In these uncertain times, we believe our multi-asset approach coupled with our selected proven fund managers will help us weather the potential storms ahead. We also continue to remain vigilant to any unforeseen events and therefore will review our portfolios and make recommendations where necessary.

2016 BUDGET: CHANGES TO PERSONAL FINANCE

George Osborne on Wednesday 16th March delivered this year’s Budget, here we have summarised the key person-

al finance matters:

NEW Lifetime ISA

From April 2017, any adult under 40 will be able to open a new Lifetime ISA for retire- ment income or to help buy a first home. Up to £4,000 can be saved each year and sav- ers will receive a 25% bonus from the government on this money.

DISMISSAL of class 2 national insurance contributions (NICs)

From April 2018, self-employed people will only need to pay one type of National Insurance on their profits, Class 4 NICs, which will also be reformed to enable people to build entitlement to the State Pension and other contributory benefits.

INCREASED personal allowance

The Personal Allowance is the amount of income you can earn before you start paying Income Tax. This is currently £11,000, and will now increase to £11,500 in April 2017.

INCREASED higher rate tax band

The point at which you pay the higher rate of Income Tax has increased this tax year from £42,385 to £43,000 and will increase to £45,000 in April 2017.

DECREASED Capital Gains Tax (CGT)

From April 2016, the higher rate of CGT has been cut from 28% to 20% and the basic rate from 18% to 10%.

INCREASED ISA allowance

The total amount you can save each year into all ISAs will be increased from £15,240 to £20,000 from April 2017.

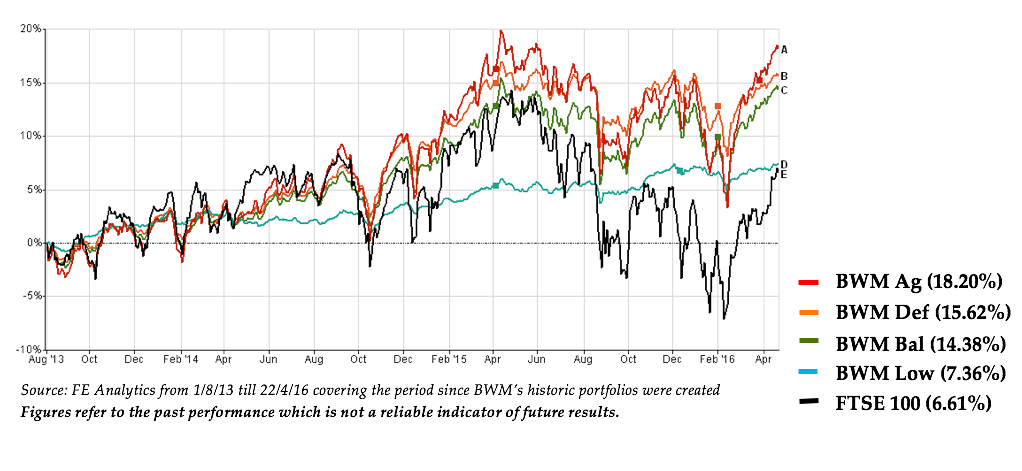

BWM PORTFOLIO PERFORMANCE UPDATE

Financial markets over the last twelve months have experience increased levels of volatility, which has subsequently had an impacted on market performances as illustrated by the decline in the FTSE 100 be-

low. Despite this, we are pleased with our portfolios resistance to these falls.

Content is opinion only and not intended to be personalised advice.

Baggette & Company Wealth Management Ltd is authorised and regulated by the Financial Conduct Authority