We are better placed to weather a property slump than after the credit crunch, but it could still be dire.

– The Times, May 2nd, 2020

With governments, advisers and economists grappling to conclude whether the economy will experience a V, U, W or L shaped recovery, we are wondering what effects this will have on the UK housing market. A majority of mortgage lenders are assuming a fall in prices of circa 5% if the government manages to engineer a V shaped recovery, however doubts must remain about the fragility of the housing market if this is not achieved.

There is no doubting that the banks are better placed than after the credit crisis of 2007/9 to manage a fall in house prices and the possibilities of negative equity and subsequent defaults. But with unemployment expected to rise sharply in the near future there are definite dangers to be experienced in the housing market. The wealth effect of a rising and vibrant property market has been a potent driver of the economy for decades. Consumers feel more confident to spend when their homes are rising in value. A crash would have the opposite effect.

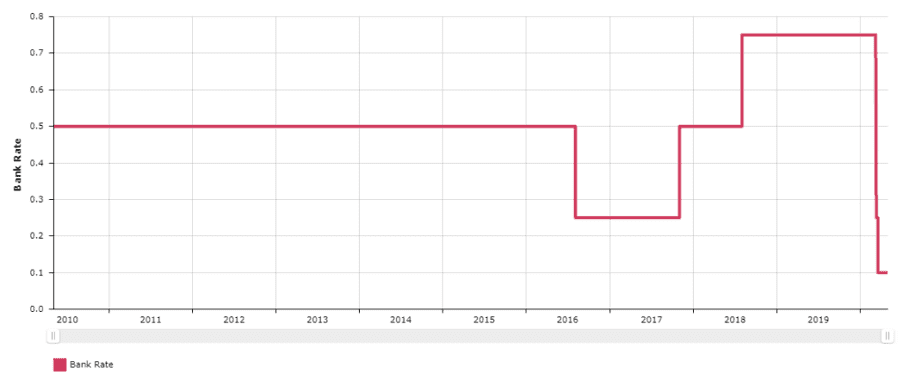

We will only know how the property market will fare once lockdown restrictions have been eased and activity starts again, but we are sure the government will want to ensure that the market will function smoothly albeit at lower values. Interest rates remain at all time lows, and it will be essential for the mortgage lenders to support borrowers both old and new in the coming months.